Simple, Fast, & Secure Financing Solutions

Supporting Canadians in boosting their finances, with growth every day.

Fast Approval

Get your amount approved quickly and efficiently.

Secure Process

Safe and reliable financial solutions.

Flexible Terms

Customizable financing options to fit your needs.

Expert Support

Dedicated assistance every step of the way.

Personalized Payment Plans That Fit Your Needs

-

Customized Repayment Plans

Tailored payment options to suit your financial situation. -

Customized Repayment Plans

Tailored payment options to suit your financial situation. -

Customized Repayment Plans

Tailored payment options to suit your financial situation.

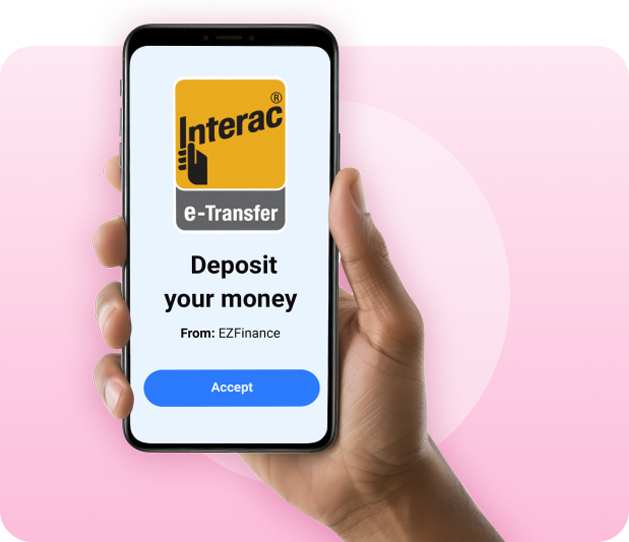

Quick Access to Your Funds

Empowering Canadians to secure a brighter financial future by offering flexible financing solutions and personalized support.

Apply Online

Complete a simple application in minutes.

Choose Your Amount

Select the amount that best meets your requirements.

Fast Funding

Get your funds delivered in less than 24 hours.

Access funds quickly

- Be 18 years of age or older.

- Be a Canadian citizen.

- Have a stable job for 3 months and direct deposit.

We are connected to all the banks in Canada

See What Our Satisfied Clients Have to Say

Learn how our tailored financing solutions have supported Canadians like you. Explore their success stories and find out why we’re a trusted choice for quick, stress-free financing.

EZFinance made it so easy to get the funds I needed. The process was quick, and the support team was incredibly helpful!

Thanks to EZFinance, I was able to secure an amount that helped my business grow. Their flexible options made all the difference!

I was impressed by how fast I received my money. EZFinance truly understands the needs of Canadians looking for quick financial solutions.

EZFinance made it so easy to get the funds I needed. The process was quick, and the support team was incredibly helpful!

Thanks to EZFinance, I was able to secure an amount that helped my business grow. Their flexible options made all the difference!

Personal Loans Disclosures, Interest Rates and Fees

Loan term:

Minimum: 62 days (≈ 2 months)

Maximum: 60 months (5 years)

Maximum Annual Percentage Rate (APR):

Our loans carry a maximum APR of 29 %. This single figure already includes: interest charged by the lender plus all preparation, administration, monitoring and management fees payable to our authorised agent-broker. No additional hidden fees apply.

Example of Refund

Principal requested: $500

Administration fee (added to principal): $232

Total amount financed: $732

Repayment schedule:10 bi-weekly payments (20 weeks)

Payment amount: $80.40

Total repayment: $804.00

APR (interest + fees, annualised): 29 %

This example is provided for illustration only. Your exact payment amount and term will depend on the assessment of your application.

- We do not offer any loans that must be repaid in full within 60 days.

- The agent-broker’s fees are set case-by-case at its sole discretion, but they are already included in the 29 % APR shown above.

- Early repayment is allowed at any time without penalty.

Be Responsible

When used responsibly, short-term financing solutions can be a suitable option. However, they typically come with higher interest rates and fees compared to loans offered by locally chartered financial institutions. These services should be used only occasionally or as a last resort when no lower-interest alternatives are available. Relying on multiple short-term financing solutions can quickly lead to excessive debt and serious financial difficulties.